If you are looking to acquire short-term funds to expand your existing business or purchase a property in London, Edinburgh, Belfast, Tottenham, Wood Green, Cuffley, Epping, Edmonton, London Borough of Waltham Forest, Potters Bar, Cheshunt, Ilford, Hatfield, Enfield, Waltham Abbey, Hertford, Barnet, Broxbourne, Buckhurst Hill, Waltham Cross, Edgware, Finchley or other areas of the UK, a bridging loan may be the right choice. Many local businesses and residents face a financial crisis when it comes to purchasing a property. That is the reason the customers are turning to bridge loans to bridge the gap between the pending dues and arranging the funds required to pay off the debt. This is particularly essential for small businesses and homeowners that want urgent funds to close the deal.

Bridging loan UK is something that usually comes into the picture as a short-term finance option for individual homeowners and organisations alike. The bridging finance is mostly preferred during the event of completing a property purchase as it requires a significant amount of money outright. The bridging loans the UK are also preferred by property investors, business owners and landowners who may be eager to get a hold of certain properties. Bridging loans are the type of financing that appeal to a number of people for a number of reasons. By using the most reliable bridging loan lenders in the UK, BridgingFinance4U will provide the right support that fulfils your needs.

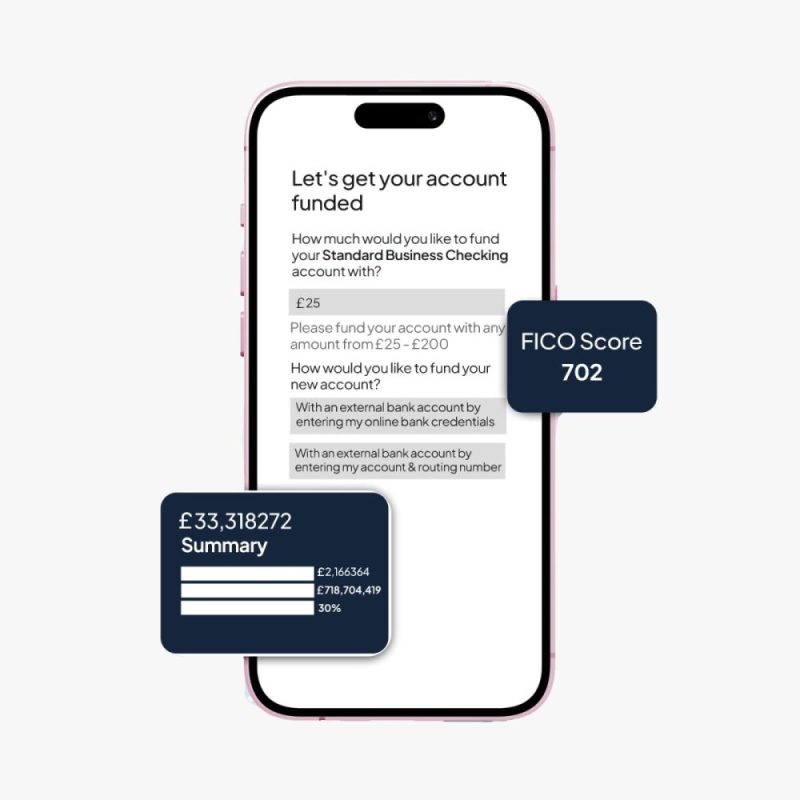

If you are presently looking for a short-term, fast and secured bridge loan, whether to expand your business or grab the best deal on a property, you have come to the right place. BridgingFinance4U promptly helps you in arranging funds from £25,000 to £50 million at the most competitive rates in the market, so you can instantly complete your property purchase or pay the bills that you missed on time. Bridging loan products and services are available even for individuals with a less-than-perfect credit file, offering flexible short-term financing solutions.

High street lenders are key players in the property finance market, offering various loan terms to borrowers. One specialized type of property finance they provide is auction finance, which is designed to support property purchases at auctions. Bridging loans, a common form of short-term financing, are also offered by high-street lenders. These loans come with specific terms and requirements, including an exit strategy that outlines how the loan will be repaid. Nationwide offer to bridge, among other lenders, offers bridging loans and ensures transparency regarding loan costs. Borrowers should carefully evaluate their options and consider the associated costs when seeking property finance from high-street lenders.