Bridging Finance Cardiff, CF1, CF10, CF11, CF14, CF24 – Bridging Finance 4U

Bridging loans in Cardiff offer an essential financial solution for property transactions that require quick and reliable funding. Commonly known as bridging finance, these loans provide short-term lending by using a property as collateral. Property finance specialists based in Cardiff deliver a variety of bridging finance options throughout the UK, catering to diverse needs and circumstances.

Bridging loans are particularly useful as an interim funding option for property purchases, allowing borrowers to secure new properties before selling their existing ones. These loans are designed for situations where speed and reliability are crucial, making them ideal for property developers, investors, and homeowners alike.

At Bridging Finance 4U, we provide comprehensive finance support you and your company can trust. As a privately owned independent boutique financier, our main focus is the UK real estate market. We arrange development finance and offer competitive bridging loan options to meet your specific needs.

Our bridging loans in Cardiff include:

- Loans up to 100% of the purchase price

- Terms starting from 1 month

- No upfront fees

- Rates from 0.59% PCM

- Fast finance and quick decisions

Whether you need to bridge a financial gap or secure a property quickly, compare bridging loan offers in Cardiff to find the best solution. Trust Bridging Finance 4U for reliable, efficient, and tailored bridging finance services.

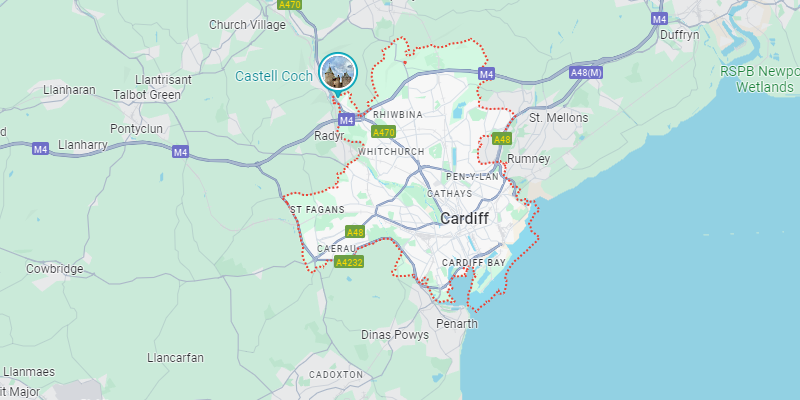

Cardiff, the capital of Wales with its central location within the UK, combined with a diverse and thriving economy, has made the city an attractive destination for various industries. Cardiff’s economy spans various sectors, including finance, insurance, manufacturing, technology, and creative industries.

The city has developed a strong reputation as a financial services centre, with prominent companies like Admiral Insurance and Legal & General establishing significant operations in Cardiff. It is home to many financial, legal, and consulting firms, contributing to its growing status in the financial sector. The technology industry in Cardiff is also flourishing, particularly in areas such as fintech, cybersecurity, and software development. The creation of the Cardiff University Innovation Hub has further encouraged collaboration between local businesses and academic institutions, driving innovation and business growth. Additionally, Cardiff is well-known for its vibrant creative industries, including TV production, film, and digital media. Several production companies call the city home, and Cardiff plays an important role in the UK’s creative economy.

Cardiff’s strategic location is another key factor that boosts its appeal to businesses. The city benefits from its proximity to major UK cities like Bristol, London, and Birmingham, making it a prime location for companies looking to expand or invest in the region. The city also boasts excellent infrastructure, with Cardiff Airport providing direct flights to international destinations, further enhancing its connectivity and global business appeal.

The Welsh Government has been proactive in supporting businesses, offering a range of financial incentives to encourage companies to set up in Cardiff. These incentives include tax breaks, funding schemes, and grants to foster innovation and business growth. Furthermore, Cardiff’s involvement in the UK’s ‘City Deal’ provides access to additional funding for infrastructure and urban development projects, making the city an even more attractive location for businesses looking to establish themselves in the region.

Contact Us

Address:

Bridging Finance 4u

525e Hertford Rd,

Enfield, London

EN3 5UA

Telephone: 020 3328 0745

Fax: 0203 137 8845

Email: [email protected]