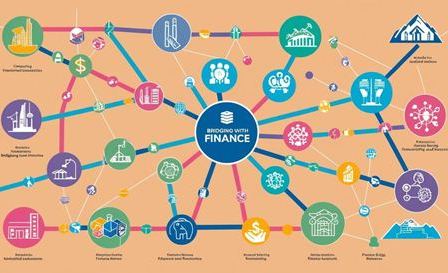

Can UK manufacturing Companies use Bridging Financing to Bridge Cash Flow Gaps? Manufacturing companies are a key part of the UK’s economy and contribute significantly to employment and GDP. Even the most successful manufacturers are faced with financial challenges, especially when it comes to managing cash flow. Many in the manufacturing sector ask: Can… Read more »